Realtor unveils 'new rules' for buying a home in today's market

As low housing inventory keeps demand high, here are the "new rules" of homebuying, according to a real estate agent. (iStock)

The days of soaring home values and bidding wars may not be through just yet. Although rising mortgage rates are expected to eventually alleviate demand, scarce housing inventory continues to pose a challenge for today's homebuyers.

According to one realtor, prospective buyers may need to shed their preconceived notions of homebuying in order to compete in this sellers market.

"Buying a house is not what it used to be, and there are some new rules to homebuying," Sam Salzwedel, a real estate agent based in Tuscon, Ariz., recently told Realtor.com.

Keep reading to see Salzwedel's new rules for buying a home in today's competitive real estate market. And if you're ready begin the homebuying process, you can visit Credible to compare mortgage rates for free without impacting your credit score.

THE BASICS OF CLOSING COSTS AND BUYER FEES

1. Get your mortgage financing in order before you shop

→ Old rule: "Find your dream home, then finalize your mortgage paperwork."

→ New rule: "Lock in a mortgage before you even start your search."

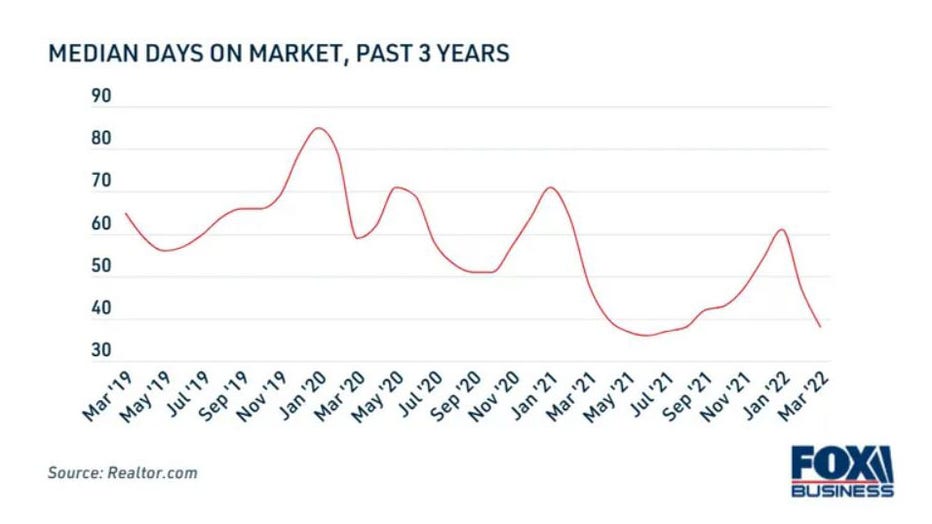

If you find a home you love but don't have a mortgage preapproval letter in hand, it may be too late to put in an offer. That's because homes are selling quickly, spending less time on the market than ever before. According to Realtor.com data, listed homes sold 10 days faster this March than they did the same time last year.

MONTHLY MORTGAGE PAYMENTS SURGED 38% ANNUALLY IN MARCH

"That house is probably going to be gone by the time you get a loan," Salzwedel said.

As soon as you're ready to start home shopping, it's time to lock in your mortgage financing. Coming prepared with a preapproval letter from a mortgage lender lets sellers know you're ready to make a purchase. You can begin the home loan process on Credible.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME

2. Search for houses listed below your ideal sales price

→ Old rule: "Shop for a house you can afford."

→ New rule: "Shop for homes priced below what you can afford."

Despite signs of cooling demand amid rising mortgage rates, homes are continuing to sell for much more than what's advertised on the listing. About half of homes sold above list price in March, according to the real estate brokerage firm Redfin.

"There's a good chance that whatever you see will sell for more than the list price, so you might want to leave yourself a little room to offer above that list price," Salzwedel said.

Do some research to determine how much home you can afford, then ask your real estate agent to show you homes that are underneath your maximum purchase price. You can also use Credible's mortgage calculator to estimate your monthly payments.

THESE ARE THE MOST NEIGHBORLY CITIES IN AMERICA, STUDY FINDS

3. Be prepared to make an offer the same day you tour a home

→ Old rule: "Tour a property, then take a day or two to decide if you want to make an offer."

→ New rule: "If you see something you like, put together a smart, competitive offer ASAP."

Buying a home is likely the largest purchase you'll make in your life, and you may end up living in your next house for a decade or more. Because homebuying is such a significant milestone, it's important not to make a rushed decision.

But with houses spending less and less time on the market, today's homebuyers may not have the luxury of taking several days to mull over things. To ensure you're buying the right home and not just any home, give your realtor a detailed list of your must-haves and deal-breakers. If possible, keep your earnest deposit low, and don't waive the home inspection.

NEW MORTGAGE PAYMENTS JUMP 8% IN FEBRUARY AMID SOARING RATES, HOME PRICES

4. Submit your most competitive offer first

→ Old rule: "Offer below asking price and wait for the seller to counter your bid."

→ New rule: "Put your big number out there from the start."

In a competitive real estate market, sellers are likely to get multiple offers within days of listing a property for sale. If you offer below the list price, they may simply move on to the next offer.

"Sellers are not making many counter offers," Salzwedel said. "They don't need to because buyers are often offering more than what sellers expected."

Some motivated buyers may even offer cash to cover the difference if the property doesn't appraise for the agreed-upon purchase price. But for many first-time homebuyers, the prospect of putting even more money upfront — potentially tens of thousands of dollars worth of expenses — may not be realistic.

Discuss your options with your real estate agent to put in the most competitive offer for your situation, without leaving your financial comfort zone. You may be able to set your offer apart from the rest by being flexible with the closing date, rather than offering more than a home's appraisal value.

WHAT IS PRIVATE MORTGAGE INSURANCE (PMI) AND HOW DOES IT WORK?

5. Don't lose hope if your offer isn't accepted

→ Old rule: "Expect to buy a home after submitting one or two offers."

→ New rule: "You might get rejected multiple times."

It can be disheartening to put together your best possible offer on your dream home just to be outbid by a cash buyer or someone who's willing to waive the inspection or appraisal. At the end of the day, you're making a purchase. The seller will typically go with the offer that's most financially beneficial to them, even if it's not yours.

"The new normal is dealing with rejection," Salzwedel said.

This doesn't mean you have to settle for less than what you want. Instead, it means you may have to be patient to find the perfect home for you. And if you're looking for the best possible mortgage offer, it's important to shop around with multiple lenders. You can compare current interest rates across lenders in the table below, and visit Credible to see mortgage offers tailored to you.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.