Millennial, Gen Z graduates plan to lower student loan payments with refinancing, survey finds

A new survey found that young student loan borrowers are exploring their repayment options, such as a student loan refinance loan, as the federal forbearance period comes to an end. Here's why that may be a smart move. (iStock)

Student loan debt is a towering obstacle for many millennial and Gen Z graduates. The sizeable monthly payments can keep borrowers from saving money to achieve some of life's financial milestones, like buying a house or starting a family.

While student loan borrowers have been able to take advantage of COVID-19 deferment, the federal forbearance period is set to expire in just a few months at the end of January 2022. Thankfully, the majority of young borrowers feel prepared to resume student loan payments when forbearance ends, according to a recent survey of 2,000 millennial and Gen Z borrowers from Laurel Road, a digital banking platform.

Additionally, a substantial portion of these young borrowers plans to take advantage of historically low student loan refinance rates to lower their monthly payments. About a third (32%) of those with private student loans and nearly half (44%) with federal student loans plan to refinance, the survey found.

Keep reading to learn more about student loan refinancing and how borrowers can use this financial tool to lower their monthly loan payments. If you decide to refinance your student loans, visit Credible to compare interest rates across multiple private lenders without impacting your credit score.

BEST PRIVATE EDUCATION LOANS FOR FALL 2021

What is student loan refinancing?

Refinancing is when a borrower takes out a new loan to pay off another loan. Preferably, the new loan would have a lower interest rate and more favorable repayment terms, so the borrower can save money over the life of the loan. You can refinance student loans, a mortgage and even credit card debt.

Many Gen Z and millennial borrowers plan on refinancing their student loans to lower their monthly payment amount as the federal student loan payment pause comes to an end.

Shafer added that it's "a great option for those looking to save over the life of their loans, creating opportunities to use that additional money to achieve savings goals as well as some much-needed fun and self-care."

Student loan refinancing can help borrowers lower their monthly payments or even get out of debt faster due to the ability to qualify for a new interest rate.

A recent Credible study found that student loan borrowers who refinanced to a shorter-term loan saved nearly $17,000 and shaved years off their debt repayment. Borrowers who refinanced to a longer-term loan saved an average of about $250 on their monthly payments — all without increasing the total interest paid.

Use a student loan refinance calculator to see how much you can save and compare repayment plans with a soft credit pull.

98% OF PUBLIC SERVICE LOAN FORGIVENESS (PSLF) APPLICATIONS REJECTED

Keep in mind that refinancing federal loans into a private loan makes you ineligible for federal benefits like administrative forbearance and even student loan forgiveness programs.

Why is it a good idea to refinance student loans now?

The Federal Reserve has kept interest rates low to boost economic recovery during the coronavirus pandemic, impacting various financial products. Student loan refinance rates are no exception.

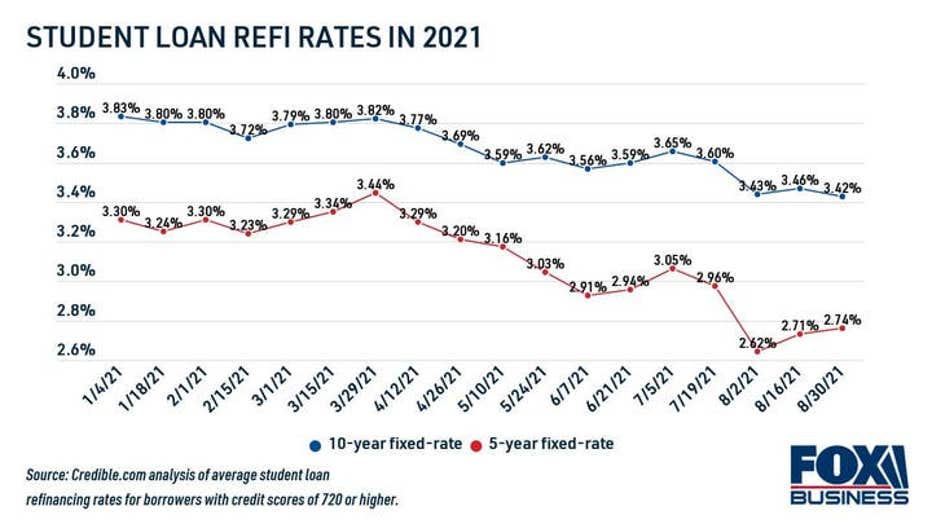

Fixed interest rates on 10-year student loans averaged 3.42% for the week of Aug. 30, according to a Credible analysis of borrowers with credit scores of 720 or higher. That's down from 4.19% one year ago. Variable interest rates are even lower — the average rate on a 5-year variable-rate loan was 2.74% during the same time period, compared with 3.12% the same time last year.

HOW TO CHECK YOUR CREDIT SCORE FOR FREE WITHOUT A HARD CREDIT PULL

Student loan consolidation lenders are prohibited from charging additional fees, so you have nothing to lose by refinancing your private student loans to a lower rate. You may be able to get an interest rate reduction by signing up for an auto-pay discount.

You can view current student loan refinance rates from real private online lenders in the table below. Get prequalified for student loan refinancing on Credible to see your estimated rate without impacting your credit score.

4 PRIVATE STUDENT LOAN TIPS FOR UNDERGRADUATES

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column