Mortgage refinance rates slip back to bargain levels to close the week | Nov. 5, 2021

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage refinancing rates for Nov. 5, 2021, which are mostly down from yesterday. (iStock)

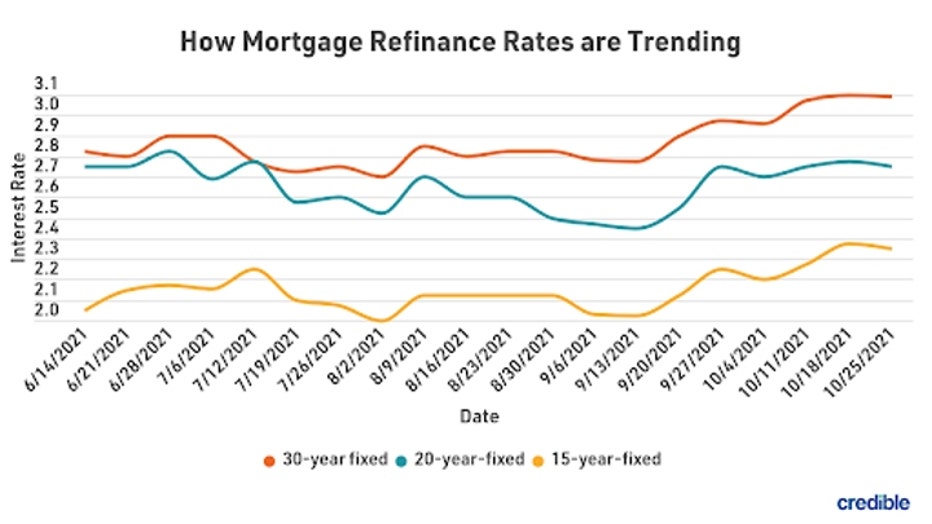

Based on data compiled by Credible, current mortgage refinance rates fell across three key terms for the third time this week, while 20-year rates remained unchanged.

- 30-year fixed-rate refinance: 3.000%, down from 3.125%, -0.125

- 20-year fixed-rate refinance: 2.750%, unchanged

- 15-year fixed-rate refinance: 2.250%, down from 2.375%, -0.125

- 10-year fixed-rate refinance: 2.125%, down from 2.250%, -0.125

Rates last updated on Nov. 5, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

Refinance rates have taken homeowners on a roller coaster ride this week, jumping up and then falling back down each day. Rates closed the week by falling again, meaning homeowners who lock in their rate today can find a bargain whether they choose a longer or shorter term. After rising to 3.125% yesterday, rates for a 30-year refinance fell to 3% today. And rates for a 10-year refinance are at a near-record low of 2.125%. Homeowners who choose this term and can manage a higher monthly payment stand to save significantly on interest over the life of their mortgage loan.

If you’re thinking of refinancing your home mortgage, consider using Credible. Whether you're interested in saving money on your monthly mortgage payments or considering a cash-out refinance, Credible's free online tool will let you compare rates from multiple mortgage lenders. You can see prequalified rates in as little as three minutes.

Current 30-year fixed refinance rates

The current rate for a 30-year fixed-rate refinance is 3.000%. This is down from yesterday. Refinancing a 30-year mortgage into a new 30-year mortgage could lower your interest rate, but may not have much effect on your total interest costs or monthly payment. Refinancing a shorter term mortgage into a 30-year refinance could result in a lower monthly payment but higher total interest costs.

Current 20-year fixed refinance rates

The current rate for a 20-year fixed-rate refinance is 2.750%. This is the same as yesterday. By refinancing a 30-year loan into a 20-year refinance, you could secure a lower interest rate and reduced total interest costs over the life of your mortgage. But you may get a higher monthly payment.

Current 15-year fixed refinance rates

The current rate for a 15-year fixed-rate refinance is 2.250%. This is down from yesterday. A 15-year refinance could be a good choice for homeowners looking to strike a balance between lowering interest costs and retaining a manageable monthly payment.

Current 10-year fixed refinance rates

The current rate for a 10-year fixed-rate refinance is 2.125%. This is down from yesterday. A 10-year refinance will help you pay off your mortgage sooner and maximize your interest savings. But you could also end up with a bigger monthly mortgage payment.

You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. Check out Credible and get prequalified today.

Rates last updated on Nov. 5, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

These rates are based on the assumptions shown here. Actual rates may vary.

Think it might be the right time to refinance? You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. Check out Credible and get prequalified today.

Rates last updated on Nov. 5, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

APR vs. interest rate: What’s the difference?

When you’re shopping for a mortgage or refinance loan, you’ll see the terms APR and interest rate arise often. They’re similar but not interchangeable.

The interest rate is the cost the lender will charge annually to loan you money. Annual percentage rate, or APR, encompasses the interest rate and other fees and charges attached to your loan.

Generally, APR gives you a better picture of the true cost of a loan since it takes into account all the costs associated with borrowing money. For a mortgage or refinance, those costs can include discount points, fees and other charges.

When you apply for a loan, you’ll usually be able to find the interest rate on the first page of your loan estimate, and the APR later in the document listed under "comparisons."

How to get your lowest mortgage refinance rate

If you’re interested in refinancing your mortgage, improving your credit score and paying down any other debt could secure you a lower rate. It’s also a good idea to compare rates from different lenders if you're hoping to refinance, so you can find the best rate for your situation.

Borrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote, and an average of $3,000 by comparing five rate quotes, according to research from Freddie Mac.

Be sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credible’s free online tool and see your prequalified rates in only three minutes.

How does Credible calculate refinance rates?

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Can you negotiate refinance rates?

Negotiation is often possible in real estate transactions, and you may be able to work with your lender to negotiate a lower refinance rate.

Having a good to excellent credit score, low debt-to-income ratio and good income may help in negotiations. Being open to compromise may also help. For example, your lender may agree to a lower interest rate if you’re willing to pay mortgage discount points up front.

The best way to ensure you get the lowest possible interest rate is to compare rates and loans from multiple mortgage lenders.

Credible also has a partnership with a home insurance broker. You can compare free home insurance quotes through Credible's partner here. It's fast, easy and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.