Considering refinancing? Here's why you should lock in your mortgage rate before Nov. 2

Federal Reserve policies have an indirect impact on mortgage rates. Ahead of the Fed's upcoming meeting in November, consider locking in a low rate for your mortgage purchase or refinance. (iStock)

Homeowners who have been considering refinancing may want to lock in a low mortgage rate before the Federal Reserve's next meeting takes place on Nov. 2-3. Although the Fed won't likely implement any rate hikes until 2022, it has signaled that it plans on tapering its bond purchases as soon as mid-November — a move that will likely affect interest rates.

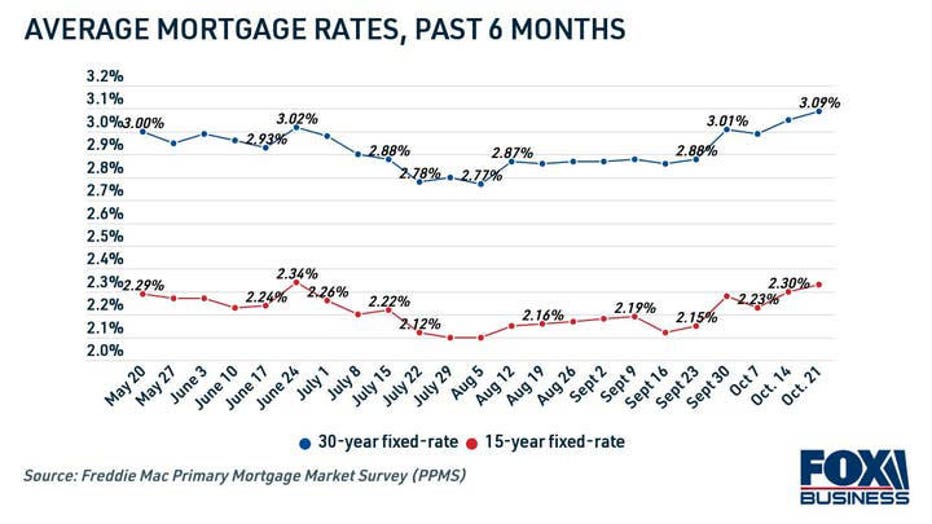

Mortgage purchase and refinance rates have already started to climb in the past few weeks, so you shouldn't wait any longer to begin the refinancing process. Get started by comparing mortgage offers across multiple lenders at once without impacting your credit score on Credible. That way, you can lock in your mortgage rate before rates rise further.

FAILURE TO LIFT DEBT CEILING MAY CAUSE MORTGAGE RATES TO RISE, REPORT FINDS

How the Federal Reserve impacts mortgage rates

The Federal Reserve has been keeping borrowing costs low to stimulate the economy since the start of the COVID-19 pandemic, which has allowed consumers to take out loans at a bargain rate. But the Fed will soon revert to its more modest pre-pandemic monetary policies, which will inevitably cause interest rates to rise.

Mortgage rates are no exception. While the Fed doesn't directly set mortgage rates, it does impact the borrowing costs for banks and lenders that offer mortgages. And when the Fed adjusts its economic outlook during its Federal Open Market Committee (FOMC) meetings, markets tend to react quickly.

While mortgage rates have been rising for the past few weeks, according to Freddie Mac, it's not likely that they'll fall to those levels again anytime soon.

Industry experts forecast that mortgage rates will continue to rise in the next year. The Mortgage Bankers Association (MBA) predicts that 30-year mortgage rates will reach 4.0% in 2022 and 4.3% in 2023. So if you've delayed refinancing your home loan in hopes of locking in a lower interest rate, now is the time to do so.

Browse current mortgage rates from real lenders in the rate table below. When you're ready to begin the refinancing process, visit Credible to compare rates that are tailored to you.

FANNIE MAE AGAIN LOWERS ECONOMIC GROWTH OUTLOOK: WHAT IT MEANS FOR INTEREST RATES

How to find the best refinance rates

Average mortgage rates generally rise and fall due to several economic factors that are out of your control, but interest rates also vary depending on several things you can control. The range of mortgage rates you're offered will be dependent on the loan amount, repayment terms, credit score and down payment. Here's how you can shop for a lower mortgage rate:

- Check your credit score and report. You can get a free copy of your credit report from all three credit bureaus on www.AnnualCreditReport.com. This will help you get a better idea of where you can improve your credit score. It's recommended that you have a credit score of at least 620 to refinance.

- Determine your refinancing goals. Do you want to pay off your mortgage faster? Consider switching to a short-term mortgage, such as a 15-year term. If you want to reduce your monthly payment, look into a long-term mortgage while locking in a lower rate.

- Compare mortgage rates across lenders. Many mortgage lenders let you get prequalified for mortgage refinancing, which gives you an idea of your estimated mortgage rate without hurting your credit. You can get prequalified through Credible's partner lenders by filling out a single form.

- Compare estimated closing costs. In addition to your mortgage rate, you'll also want to consider the fees each lender charges. Mortgage refinancing closing costs are typically about 2-5% and can be rolled into the total loan amount.

- Choose a lender and formally apply. Once you've settled on a refinancing offer, you'll need to formally apply through the lender. You'll work with a mortgage broker who will guide you through the rest of the refinancing process.

Still not sure if mortgage refinancing is right for you? It's free and easy to browse mortgage interest rates on Credible. Once you have an idea of your estimated terms, use a mortgage payment calculator to determine if refinancing is worthwhile.

HOME EQUITY LOAN VS. HOME EQUITY LINE OF CREDIT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.