Senate blocks bill to suspend debt limit, avert government shutdown that may delay Social Security

The Treasury Department has taken extraordinary measures to avoid a financial crisis since the previous debt issuance suspension period expired. But without a new debt limit, the federal budget will hit reach the debt ceiling. (iStock)

Senate Republicans voted unanimously on Monday to block a bill that would suspend the debt ceiling until December 2022, with the deadline for funding the federal government just days away.

Unless Democrats find a way to address the debt limit, the government will shut down and be unable to meet its financial obligations by Oct. 18, Treasury Secretary Janet Yellen wrote in a letter delivered to Congress following the vote.

GOP lawmakers, led by Senate Minority Leader Mitch McConnell, wouldn’t support the bill because they disapprove of the Biden administration's economic agenda that would increase taxes on the wealthy and fund new spending on child care, health care and infrastructure.

During the Trump administration, the debt limit was suspended three separate times, according to Treasury Secretary Janet Yellen. The most recent suspension was passed on a bipartisan basis in 2019 — it expired in June 2021. The vast majority of the debt currently subject to the debt limit was accrued before President Biden took office.

FAILURE TO RAISE DEBT CEILING MAY DELAY SOCIAL SECURITY, CHILD TAX CREDITS

If Congress fails to address the debt limit and the government goes into default for the first time in history, it would cause catastrophic damage to the country's credit rating, Yellen wrote in a recent op-ed for The Wall Street Journal. This could send financial markets into a tailspin that may lead to an economic recession unless the issue is resolved.

Failure to raise or suspend the debt ceiling could also lead to delays in Social Security and child tax credit checks this October. Yellen said that about 50 million seniors would be impacted, alongside millions of American families who rely on the child tax credit to make ends meet. Federal employees may also experience paycheck delays.

If you're one of the millions of Americans who rely on timely Social Security checks, now is a good time to prepare your finances in the event of a government shutdown. Keep reading to learn more about what you can do with your debt obligations, such as forbearance and refinancing. You can compare student loan refinance offers and mortgage rates on Credible's online marketplace without impacting your credit score.

MILLIONS OF AMERICANS FEAR MISSING DEBT PAYMENTS, NY FED REPORTS

How to manage your debts if Social Security is delayed

Millions of Americans rely on federally funded income programs like Social Security, but those much-needed checks may be delayed in October if the government is unable to meet its debt obligations.

Although there's still a chance that Congress will work together to develop a solution to this problem, it's smart to take a look at your finances just in case Social Security checks are delayed. Here are a few things you can do now to prepare.

EVICTION MORATORIUM UPDATE: WARREN, PROGRESSIVES INTRODUCE BILL AIMED AT EXTENDING BAN

Mortgage debt

Your mortgage is likely your largest debt obligation, and most of the time, missing a payment isn't an option. If you fail to repay your home loan, you risk losing the roof over your head and ruining your credit score in the process.

Thankfully, there are several ways to tide you over if you can't make a mortgage payment. First, you could consider enrolling in mortgage forbearance. This essentially pauses your mortgage payment for a period of time, typically a few months. Interest may accrue during the forbearance period, so keep in mind that deferring your mortgage may add to interest charges over time.

You could also consider mortgage refinancing. With mortgage rates holding steady at unprecedented lows, now could be a good time to refinance your home loan. Mortgage refinancing may help you lower your monthly payment or even pay off your debt faster.

Use a mortgage calculator to estimate your new monthly payment, and compare mortgage refinance rates without impacting your credit score on Credible.

FSA PREPARES FOR 'UNPRECEDENTED TASK' OF RESUMING STUDENT LOAN PAYMENTS AFTER FORBEARANCE

Student loan debt

Federal student loans are currently in administrative forbearance, which means payments are paused and interest does not accrue. The Biden administration issued a "final extension" of the student loan payment pause that expires in February 2022, so it won't be a problem if you need to miss your federal student loan payment in October due to delayed federal income.

Private student loans aren't covered by the COVID-19 forbearance period, though, so you could be penalized for missing a payment. If you have private student loan debt, consider contacting your student loan servicer to enroll in economic hardship forbearance to temporarily pause your monthly student loan payments.

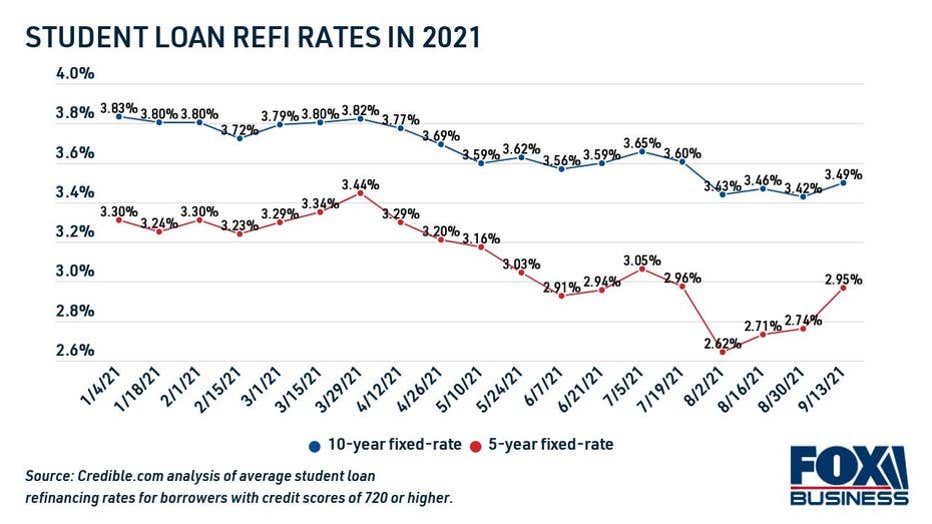

You can also refinance your private student loans while interest rates are near historic lows, according to data from Credible.

BIDEN DOESN'T HAVE AUTHORITY TO CANCEL STUDENT DEBT, HOUSE SPEAKER NANCY PELOSI SAYS

Refinancing your student loans to a longer repayment term can make it possible to lower your monthly payment. A recent Credible analysis found that borrowers who refinanced to a longer-term loan were able to lower their monthly payments by more than $250 — all without adding to the cost of borrowing the loan.

Use Credible's student loan calculator to see if you can lower your monthly payments by refinancing.

SENATE MAJORITY LEADER CHUCK SCHUMER RENEWS CALLS FOR STUDENT DEBT CANCELLATION

Credit card debt

Making the minimum payment on your credit cards can result in exorbitant interest costs over time. But missing a minimum payment may result in late fees and penalty APRs that can drive the cost of borrowing even higher.

If you're unable to make your credit card payment without your Social Security check, you could consider consolidating your debt with a personal loan to lower your monthly payments.

Personal loans offer fast, lump-sum funding that's repaid in fixed monthly payments over a set period of months or years. They come with low, fixed interest rates compared with the high, variable interest rates of credit cards. The current average interest rate on a two-year personal loan is 9.58%, according to the Federal Reserve, compared with 16.30% for credit card accounts assessed interest.

Thanks in part to lower interest rates, it may be possible to save money on your monthly debt payment while putting your debt on a structured repayment plan. Credit card holders who can secure a lower interest rate on a personal loan have the chance to save $66 or more on their monthly payments by refinancing, per Credible estimates.

Learn more about personal loans for debt consolidation on Credible. You can compare offers from multiple personal loan lenders to make sure you're getting a good deal.

AOC AIMS TO EXTEND PANDEMIC UNEMPLOYMENT INSURANCE: WHAT TO DO IF YOU NEED CASH NOW

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.