Student loan rates set new record lows – how to know if you should refinance

With student loan rates at historical lows, is it a good time to refinance student loans? See personalized loan interest rates without affecting your credit score on Credible. (iStock)

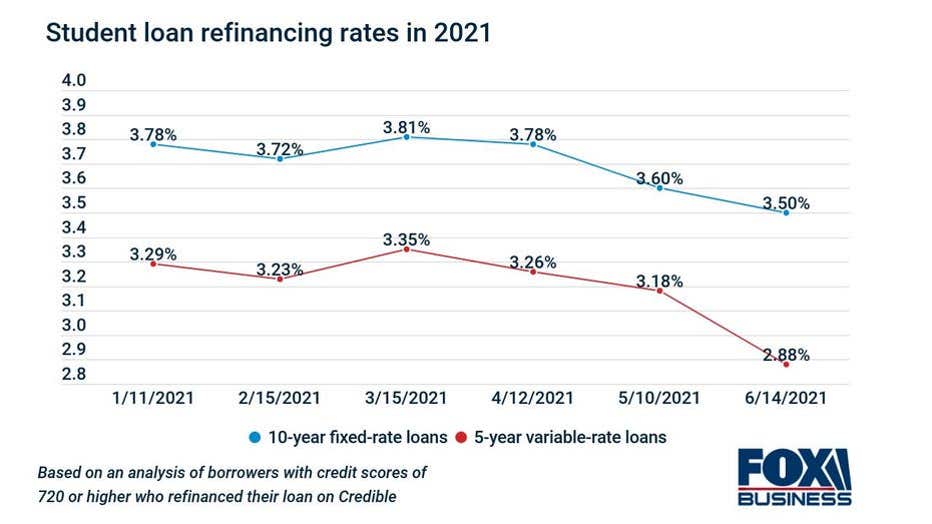

If you've been considering refinancing your private student loans, there's never been a better time to do so. Student loan refinancing rates set a new record low for the week of June 14, based on an analysis of borrowers with credit scores of 720 or higher who refinanced their student loans on Credible's online marketplace.

The interest rate on 10-year fixed-rate loans fell to 3.50%. That's down from the previous record low of 3.57% last week, and it's nearly a full percentage point lower than a year ago when it was at 4.44%.

Borrowers who choose a 5-year variable-rate loan can get interest rates as low as 2.88%, which is the lowest interest rate this type of loan has seen in all of 2021. It's down from 2.92% the week prior.

To get the lowest rate possible on your private student loan, it's important to shop around across multiple lenders. You can compare real student loan refinancing offers on Credible for free, all without affecting your credit score.

STUDENT LOAN REFINANCING RATES DROP AGAIN TO RECORD LOW: HOW TO FIND YOUR RATE

Is it a good time to refinance student loans?

The choice to refinance your student loans depends on the type of loan you have and the interest rate it carries. It's not currently recommended to refinance federal student loans, as you could lose protections like income-driven repayment, hardship forbearance and even possible student loan forgiveness in the future.

If you have private student loans, though, there's never been a better time to get a lower rate on your college debt. Student loan refinancing rates on Credible have been falling steadily in the past year, setting record lows in mid-June.

CAN’T AFFORD YOUR STUDENT LOAN PAYMENT? TRY THESE 4 THINGS

Check out the rate table below, where you can see rates offered by real student loan lenders. If you want to refinance private student loans, you can get prequalified on Credible to compare estimated interest rates across multiple lenders.

WHAT TO KNOW WHEN LOOKING AT YOUR STUDENT LOAN INTEREST RATE

How to know if student loan refi is right for you

You should consider refinancing your private loans if you can secure a lower interest rate than what you're currently paying. Since student loan refinancing doesn't come with fees, like closing costs for mortgage refinancing, it's easier to determine how much money you can save.

Student loan borrowers who took out private loans even just a few years ago were paying much higher interest rates than they may qualify for now. Average interest rates for those who took out private student loans on Credible for the year ending May 13, 2018 were much higher:

- 7.64% for a 10-year fixed-rate loan

- 6.17% for a 5-year variable-rate loan

A hypothetical borrower who took out $30,000 worth of 10-year, fixed-rate private student loans in May 2018 at a 7.64% interest rate was making monthly payments of $358. Assuming three years of on-time payments, the borrower could refinance the remaining $17,112 balance into a new 10-year fixed-rate loan at 3.50%, reducing their monthly payments by nearly $200.

See how much you can save on your college debt by entering your current and new loan terms in Credible's student loan payment calculator.

PAYING A STUDENT LOAN WITH A CREDIT CARD? HERE'S WHAT TO CONSIDER

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.