30-year mortgage rates hit 6-month high: Look to shorter terms for a deal | Oct. 11, 2021

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage rates for Oct. 11, 2021, which are a mixed bag from last Friday. (iStock)

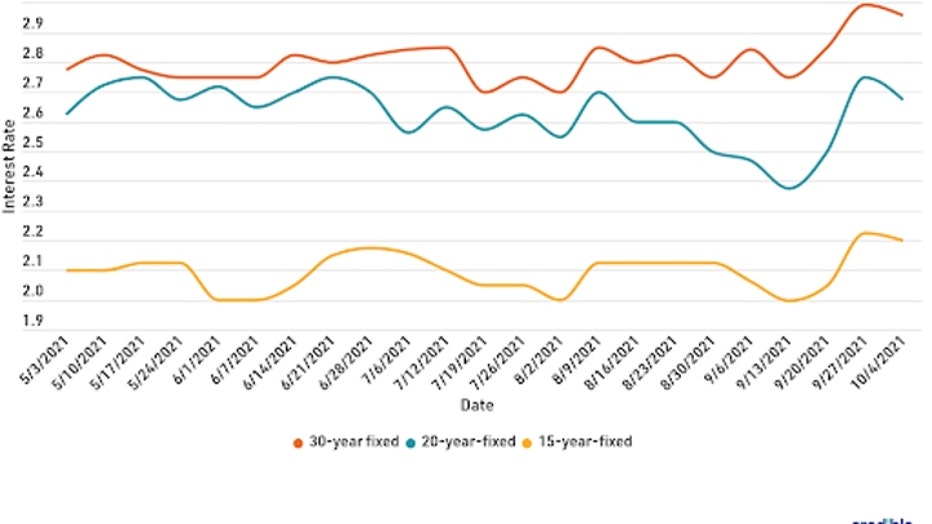

Based on data compiled by Credible, mortgage rates jumped for the longest repayment term, fell for the shortest, and held steady for mid-length terms since last Friday.

- 30-year fixed mortgage rates: 3.125%, up from 2.990%, +0.135

- 20-year fixed mortgage rates: 2.750%, unchanged

- 15-year fixed mortgage rates: 2.250%, unchanged

- 10-year fixed mortgage rates: 2.125%, down from 2.250%, -0.125

Rates last updated on Oct. 11, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

What this means: While a 3.125% 30-year mortgage rate still promises lower interest costs over the life of a mortgage, shorter repayment terms may be a better deal today. Buyers looking for a low interest rate and a lower monthly mortgage payment may find 20-year rates particularly appealing, as they’ve rested at 2.750% for four straight days.

To find the best mortgage rate, start by using Credible, which can show you current mortgage and refinance rates:

Browse rates from multiple lenders so you can make an informed decision about your home loan.

Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

Looking at today’s mortgage refinance rates

Although refinance rates are usually higher than purchase rates, today’s mortgage refinance rates mirror today’s mortgage purchase rates. The average mortgage refinance rate is 2.563%. If you’re considering refinancing an existing home, check out what refinance rates look like:

- 30-year fixed mortgage rates: 3.125%, up from 2.990%, +0.135

- 20-year fixed mortgage rates: 2.750%, unchanged

- 15-year fixed mortgage rates: 2.250%, unchanged

- 10-year fixed mortgage rates: 2.125%, down from 2.250%, -0.125

Rates last updated on Oct. 11, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

A site like Credible can be a big help when you’re ready to compare mortgage refinance loans. Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Credible has earned a 4.7-star rating (out of a possible 5.0) on Trustpilot and more than 4,500 reviews from customers who have safely compared prequalified rates.

Factors that influence mortgage rates (and are out of your control)

Many factors influence the interest rate a lender may offer you. Some — such as your credit score — are in your control. But others you have no ability to affect, such as:

- The economy — During financial downturns, the Fed may lower interest rates to try to stimulate the economy. And when the economy is doing well, interest rates can rise.

- Inflation — Interest rates tend to move with inflation. When the overall cost of goods and services increases, interest rates are also likely to rise.

- The Federal Reserve — The Fed may choose to lower interest rates to stimulate a struggling economy, or raise rates in an attempt to put the brakes on inflation.

- Macro employment trends — When many people are out of work, as they were during the months of pandemic lockdown, mortgage rates may fall. As employment increases, interest rates typically also increase.

Current mortgage rates

Today is the fifth straight day that 30-year mortgage rates have been near or above 3%. Buyers looking to get ahead of further mortgage rate increases may want to lock in their rate now.

Current 30-year mortgage rates

The current interest rate for a 30-year fixed-rate mortgage is 3.125%. This is up from last Friday. Thirty years is the most common repayment term for mortgages because 30-year mortgages typically give you a lower monthly payment. But they also typically come with higher interest rates, meaning you’ll ultimately pay more in interest over the life of the loan.

Current 20-year mortgage rates

The current interest rate for a 20-year fixed-rate mortgage is 2.750%. This is the same as last Friday. Shortening your repayment term by just 10 years can mean you’ll get a lower interest rate — and pay less in total interest over the life of the loan.

Current 15-year mortgage rates

The current interest rate for a 15-year fixed-rate mortgage is 2.250%. This is the same as last Friday. Fifteen-year mortgages are the second most common mortgage term. A 15-year mortgage may help you get a lower rate than a 30-year term — and pay less interest over the life of the loan — while keeping monthly payments manageable.

Current 10-year mortgage rates

The current interest rate for a 10-year fixed-rate mortgage is 2.125%. This is down from last Friday. Although less common than 30-year and 15-year mortgages, a 10-year fixed-rate mortgage typically gives you lower interest rates and lifetime interest costs, but a higher monthly mortgage payment.

You can explore your mortgage options in minutes by visiting Credible to compare current rates from various lenders who offer mortgage refinancing as well as home loans. Check out Credible and get prequalified today, and take a look at today’s refinance rates through the link below.

Thousands of Trustpilot reviewers rate Credible "excellent".

Rates last updated on Oct. 11, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

How mortgage rates have changed

Today, mortgage rates are up compared to this time last week.

- 30-year fixed mortgage rates: 3.125%, up from 2.875% last week, +0.250

- 20-year fixed mortgage rates: 2.750%, up from 2.500% last week, +0.250

- 15-year fixed mortgage rates: 2.250%, up from 2.125% last week, +0.125

- 10-year fixed mortgage rates: 2.125%, up from 2.000% last week, +0.125

Rates last updated on Oct. 11, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

These rates are based on the assumptions shown here. Actual rates may vary.

If you’re trying to find the right rate for your home mortgage or looking to refinance an existing home, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

With more than 4,500 reviews, Credible maintains an "excellent" Trustpilot score.

How does the Federal Reserve affect mortgage rates?

The Federal Reserve System — or "The Fed," as it’s commonly called — is the United States’ central bank. It’s tasked with taking steps to keep the economy safe, stable and flexible. Consequently, the Fed controls the U.S. money supply and short-term interest rates and sets the Fed funds rate, which is the rate that banks apply when borrowing from each other overnight.

But the Fed doesn’t actually set mortgage rates. Rather, multiple things the Fed does influence mortgage rates. For example, while mortgage rates don’t mirror the Fed funds rate, they do tend to follow it. If that rate rises, mortgage rates typically rise in tandem.

The Fed also buys and sells mortgage-backed securities, or MBS — a package of similar loans that a major mortgage investor buys and then resells to investors in the bond market. When the Fed buys a lot of mortgage-backed securities, it creates demand in the market, and lenders can make money even if they offer lower mortgage rates. So rates tend to be lower when the Fed is doing a lot of buying.

When the Fed buys fewer MBS, demand falls and rates will likely rise. Similarly, when the Fed raises the Fed fund rate, mortgage rates will also increase.

Looking to lower your home insurance rate?

A home insurance policy can help cover unexpected costs you may incur during homeownership, such as structural damage and destruction or stolen personal property. Coverage can vary widely among insurers, so it’s wise to shop around and compare policy quotes.

Credible has a partnership with a home insurance broker. You can compare free home insurance quotes through Credible's partner here. It's fast, easy and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.